Yo, fam! By now you’re well-versed in how Ethereum works and how Layer 2 blockchains like Base fit into the picture. You’ve almost earned your own pair of VR goggles. Understanding what’s going on under the hood is half the battle. But how do you actually drive this crypto thing?

This isn’t like the time you fired up your parent’s car and drove in around in circles on the cul de sac while they were at work. DeFi (decentralized finance) in crypto is way cooler than joyriding Mom’s minivan. And you don’t have to worry about the neighbors telling your parents.

This is where we stop talking nerd theory and start doing awesome sh*t. Think of DeFi as the financial system’s no-permission-needed alternative. It’s the Wild West of money, where you can swap, lend, and borrow without ever asking some suit in a skyscraper for permission.

Forget “digital pet rocks.” We’re about to turn those boring rocks into chiseled tools of blockchain finance.

DeFi Demystified - It’s Money, But With Code

If you start googling “What is DeFi?”, you’re gonna get hit with a firehose of crypto-geek buzzwords.

- “Permissionless financial ecosystems”

- “disintermediation of legacy banking”

- “programmable money”

Okay, that last one’s not too bad, but WTF? It’s enough to make you want to log off and go back to watching cat videos, even if you think cats are kinda sketchy.

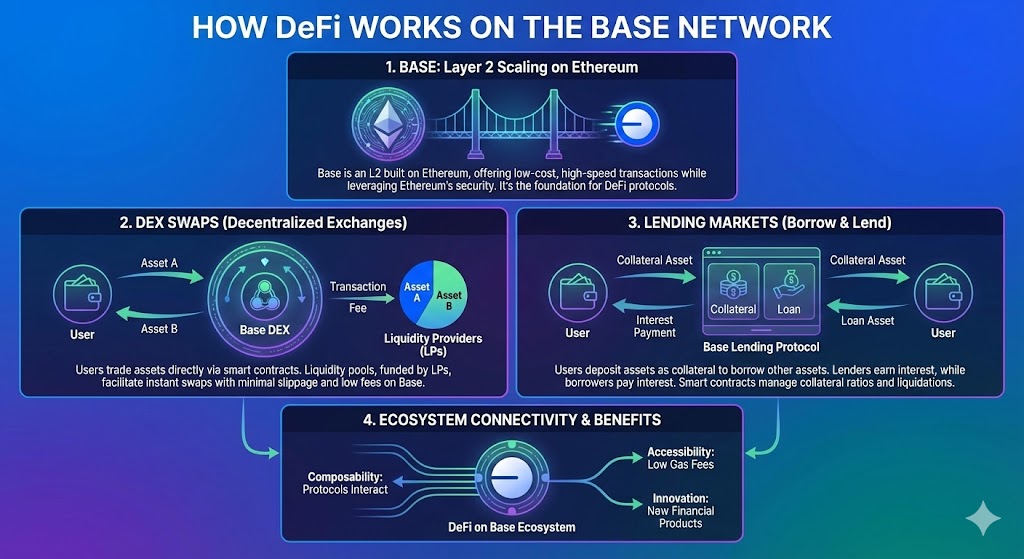

Here’s the no-BS definition: DeFi is just a bunch of smart contracts that do the jobs banks and brokers do in the analog world. The smart contracts handle the math and the handoffs. No banker needed.

That’s it. It’s a bunch of software switches for money. Instead of a teller, you have code. Instead of a loan officer, you have an algorithm. It’s all automated, transparent, and runs 24/7 without some dude in a suit peering over his glasses at your wrinkled Def Leppard t-shirt.

Let’s focus on the three main things you’ll actually do when you’re starting out in DeFi-land:

- Swapping: Trading one token for another. Like trading your baseball cards for a friend’s video game, but with crypto and without the risk of your mom throwing them out.

- Lending & Borrowing: Being the bank. You supply your crypto to a giant pool and earn interest from people who borrow it. You get to be the fat cat for once. Or… you can also borrow. You put up your crypto as collateral and borrow against it. It’s like a pawn shop, but the guy working there is a robot and he doesn’t judge you.

- Staking: Earning a yield. This is the tricky one because somehow every time you lock tokens in a smart contract to earn a yield, the internet decided to call it “staking.” We’ll run with that definition because it’s everywhere now, but just know there are different types of staking.

And why are we doing this on Base? Because while Ethereum is the king, its gas fees can still get spendy for small transactions. Using Base feels like buying a $0.01 hoodie because someone marked the price wrong. It’s the perfect training grounds to get your hands dirty without losing your Def Leppard shirt on fees.

Your First Swap - How to Trade Sh*tcoins Like a Pro

Alright, time for the main event. Your first real DeFi action. We’re about to do a DEX swap, like a proper degen.

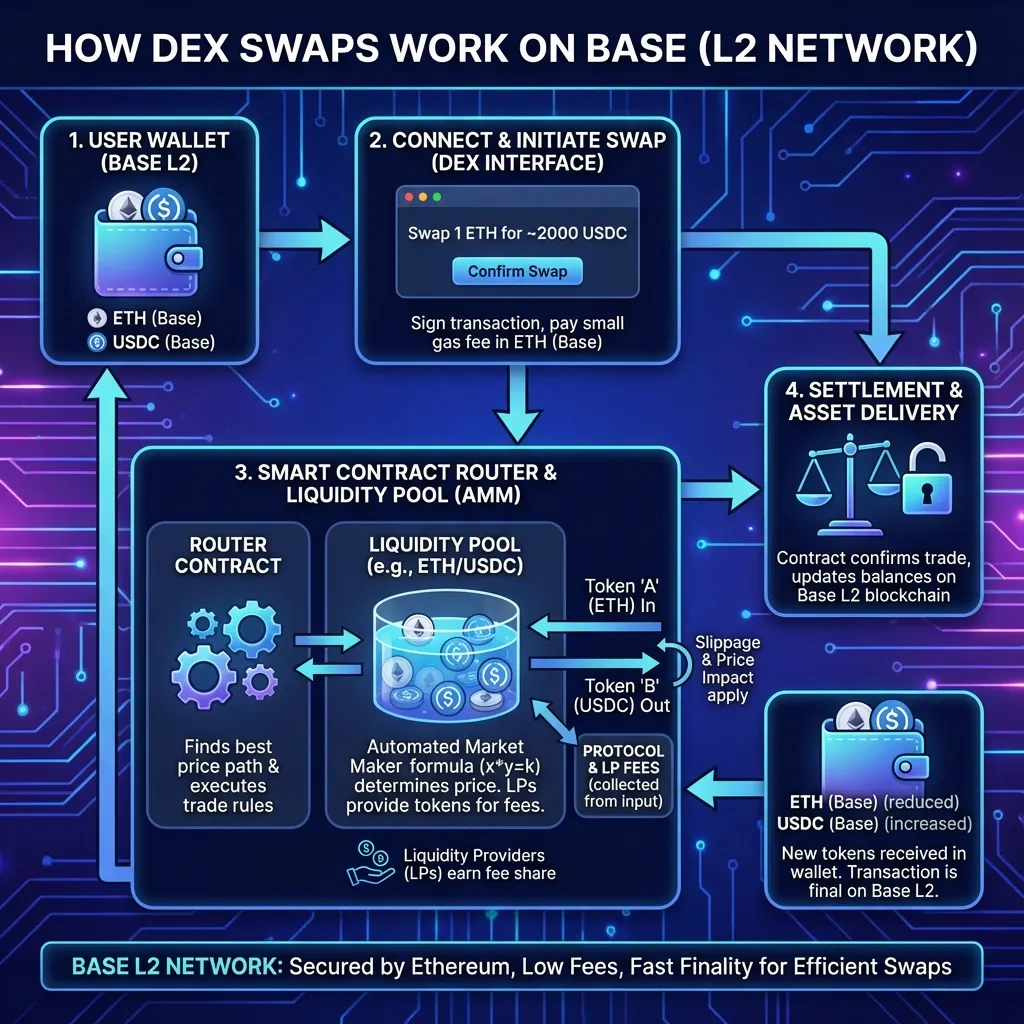

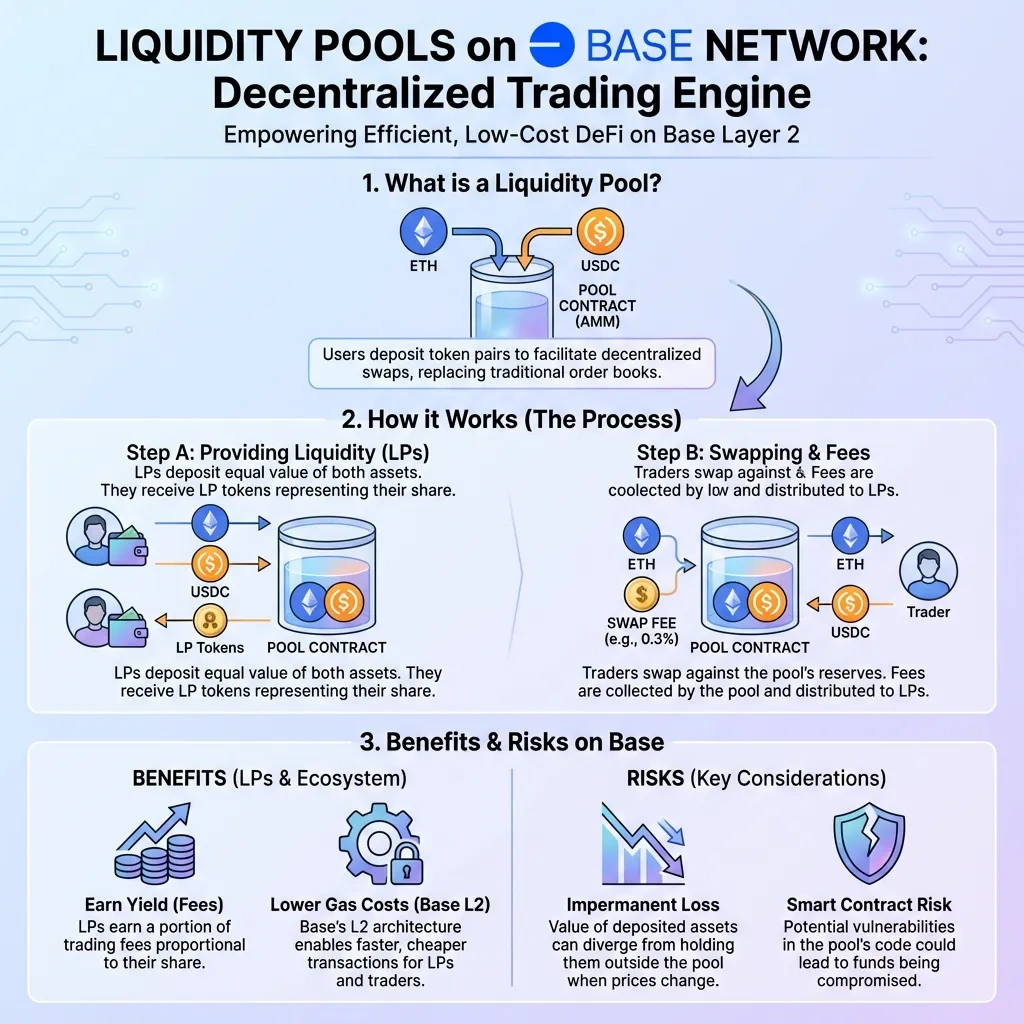

A DEX, or Decentralized Exchange, is exactly what it sounds like. It’s an exchange with no central authority. It’s just a smart contract sitting on the blockchain, waiting for you to come trade. Think of it like a public pool of tokens (a liquidity pool). When you want to swap something you have for something else, you tell the contract how much and which tokens. For example, you can tell the contract how much ETH you want to spend and the smart contract gives you back the equivalent amount of whatever token you select. You’’ just pay a small fee for everyone else who’s chipping in to keep the pool full.

So, how do you actually do a DEX swap? It’s easier than you think.

Step 1: Get Your Wallet Sorted, First

You can’t show up to the party without an ID. In the crypto world, your wallet address is your identity on the network. If you don’t have a wallet already, grab MetaMask or Rabby. They’re both pretty good. Next, secure your seed phrase offline. This secret phrase is the key to your crypto kingdom, so guard it well.

Step 2: Get Some ETH onto Base

If you have an account with Coinbase (or most other platforms) you can buy ETH with fiat currency (like the US dollar) and send the ETH to your wallet using the Bse netowkr. If you have ETH sitting on Ethereum, we need to teleport it over to Base. This is called “bridging.” The easiest and safest way to bridge to Base is to use the official Base Bridge. You connect your wallet, select Ethereum as the source and Base as the destination, and boom, your ETH appears on the other side, ready to spend on whatever your degen mind dreams up. After the bridging fees (paid to Ethereum), it’ll get cheaper. We’re on Base now, baby.

Step 3: Pick a DEX and Connect

Now for the fun part. You need to find a DEX that lives on Base. The big players are Uniswap and Aerodrome. For your first time, lets choose Uniswap. Go to the Uniswap website and look for a “Connect Wallet” button. Click it, approve the connection in your wallet, and you’re in. The DEX can now see your funds on Base.

Step 4: Make the Swap

This part feels just like using a regular exchange.

You’ll see two boxes: “Sell” and “Buy.” Let’s swap some ETH for somehting else.

- Select ETH in the “Sell” box.

- In the “Buy” box, you can paste the contract address of the token you want to buy, or search for it if it’s a popular one. Be careful, fam. There are some impostors out there and tokens can share the same ticker.

- Enter the amount of ETH you want to swap. You’ll see the amount of the other token you’ll receive.

PRO-TIP: Look for the “Settings” or gear icon. You’ll see something called “Slippage Tolerance.” This is for price swings. If the price moves against you more than this percentage while you’re trying to trade, the transaction will fail (to protect you). For normal stuff, 0.5% or 1% is usually fine. If you’re trading a some crazy new memecoin token, you might need to bump it up to 2-3%. Don’t go crazy with the slippage, fam. The swap contract always does what you tell it to, even if it’s a really bad idea.

Step 5: Approve and Execute

When you hit “Swap,” Your wallet app will pop up twice. The first time is to “Approve” the DEX to spend your ETH. This is a security feature. You’re giving the smart contract permission once. The second time is to actually execute the swap. Confirm both, wait a few seconds for Base to do its thing, and just like that you’re a DeFi trader, you degen, you. just made your first DeFi trade. Now go check your wallet and watch the price go down.

Becoming the Bank - Lending Your Crypto for Passive Gains

Alright, so you’ve successfully swapped some tokens without a stupid broker. Now, it’s time to put your banker hat on. Looks good on ya!

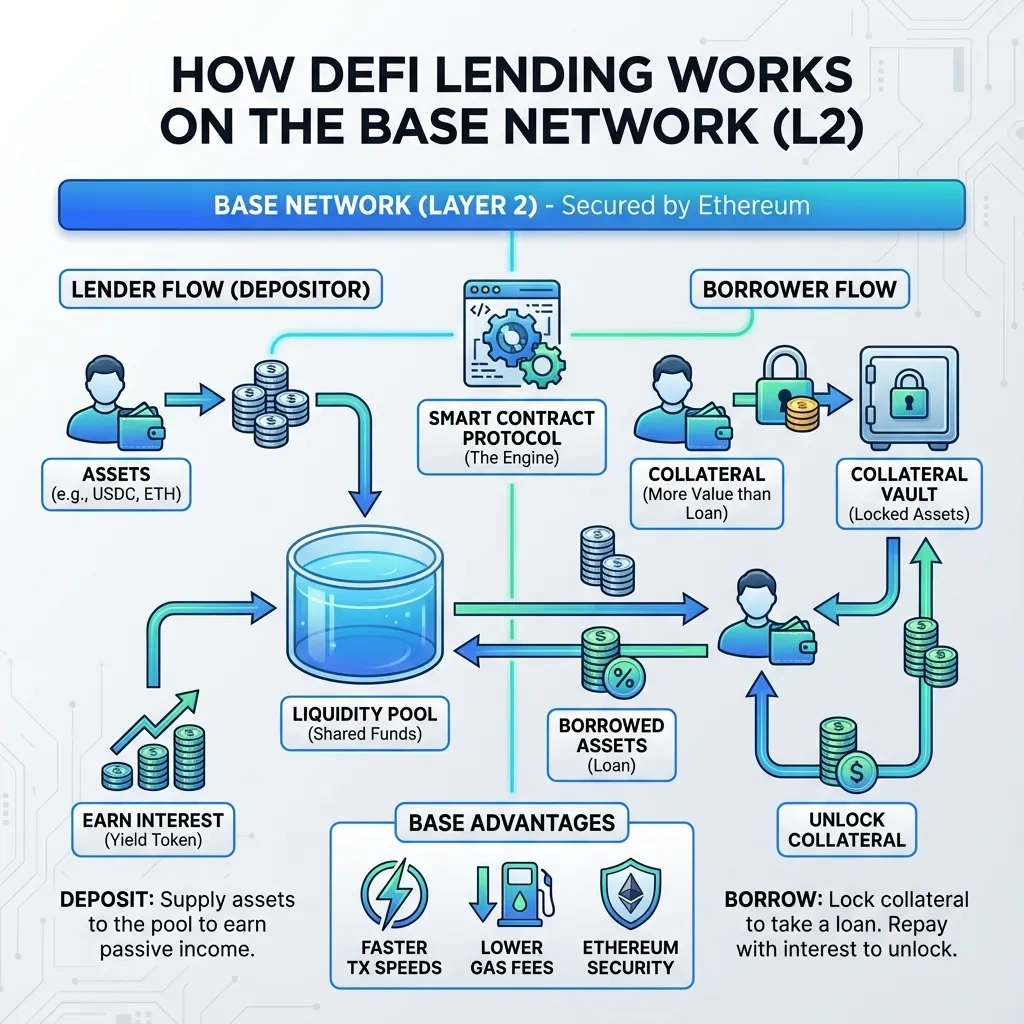

In DeFi, we cut out the middleman. You are the bank.

Here’s the no-BS breakdown: You lend your crypto to a smart contract-run lending pool. Other people come along and borrow from that pool. They pay interest, and that interest gets paid directly to you, proportinal to your share of the pool. And your bank is open 24/7, so you can lend to anyone, anywhere in the world.

The big name in the game that you’ll find on Base is Aave. They’ve been around since the OG DeFi days and have survived more market crashes than a cockroach Aave’s a good place to start. The protocol even has a user-funded insurance pool, funded by staking. We’ll get to staking in a bit.

So how does crypto lending actually work?

- Go to Aave on Base: Visit the official Aave app and make sure you’re connected to the Base network in your crypto wallet.

- Supply Your Crypto: You’ll see a big “Markets” dashboard. Find the asset you want to lend. Let’s say ETH or a stablecoin like USDC. Click “Supply” and enter the amount you want to deposit.

- Get Your ‘aTokens’: Once you supply your crypto, the protocol gives you back a special token in return. If you supply USDC, you get aUSDC. If you supply ETH, you get aETH. These are called “aTokens.” These are basically a receipt. This receipt is special, though. It automatically earns interest in your wallet. Just by holding it, the token’s value creeps up over time as you earn more interest. Cool.

The Risk (Let’s Keep It Real):

The main risk is smart contract risk. Even with a battle-tested protocol like Aave, there’s always a tiny chance some genius hacker finds a flaw in the code and drains the pool. It’s rare, but it’s the price of admission for not having a bank. And banks have their issues too. Anyone remember 2008?

Then there’s liquidation. When you supply crypto, you’re also enabling the borrowing side of the protocol. If someone borrows against their collateral and the value of their collateral crashes, the protocol sells it to make sure lenders get their money back. However, there’s a teeny chance that the liquidated funds won’t cover the debt. This shortfall, if it happens, is socialized across the entire lending pool.

For starters, maybe just stick to supplying the big, established assets like ETH, WBTC, or USDC. You’re here to earn some passive gains, not to be a venture capitalist for the latest “DogElonMoonFrog” token. Be boring and make some bank, so to speak.

Getting a DeFi Loan - Borrowing Without Selling Your Bags

So you’re a big shot lender now. But what if you need some fast cash to buy more of the dip, or you just want to pay rent without selling your precious ETH (that you’re sure is going to moon)?

This is where borrowing comes in. In the real world, getting a loan means boring paperwork, creepy credit checks, and awkward conversations with a guy who looks concerned while judging your life choices. In DeFi, it’s as easy as supplying your crypto as collateral.

The concept is simple: You use your crypto to back your loan.

It’s the reverse of what we just did as a lender. Instead of supplying USDC to the pool, you’re supplying your ETH. The protocol locks up the ETH as collateral and lets you borrow a different asset.

Wait. Why would anyone do this?

Because you don’t want to sell, you HODLer, you. If you sell your ETH to buy something else, you miss out on any potential price gains. If you borrow against it, you still own your ETH (and you don’t trigger a taxable event for selling at a gain).

You can use the borrowed USDC for whatever you want, and if the price of ETH moons, you’re still along for the moon mission.

So how do you actually borrow in DeFi?

You’ll use the same protocol, Aave, just a different button.

- Go to Aave on Base: You’re already there, still looking like a cool banker.

- Supply Your Collateral: First, you need to supply the asset you want to use as collateral. Let’s say you’re supplying 1 ETH. Click “Supply,” approve the transaction, and boom, your ETH is now locked up, working for you.

- Borrow Against It: Now, go to the “Borrow” section. You’ll see a list of assets you can borrow and how much you can borrow. You won’t be able to borrow the full value of your 1 ETH. There’s something called a Loan-to-Value (LTV) ratio. For ETH on Aave, it might be around 75-80%. This means you can borrow up to 80% of your ETH’s value. If 1 ETH is worth $3,000, you can borrow up to $2,400 worth of USDC. But don’t fly too close to the sun on this, fam. Safety first. You don’t want to get liquidated. More on that in a bit.

- Execute the Loan: Select USDC, enter the amount you want to borrow, and hit “Borrow.” The USDC will appear in your wallet instantly, ready to be deployed.

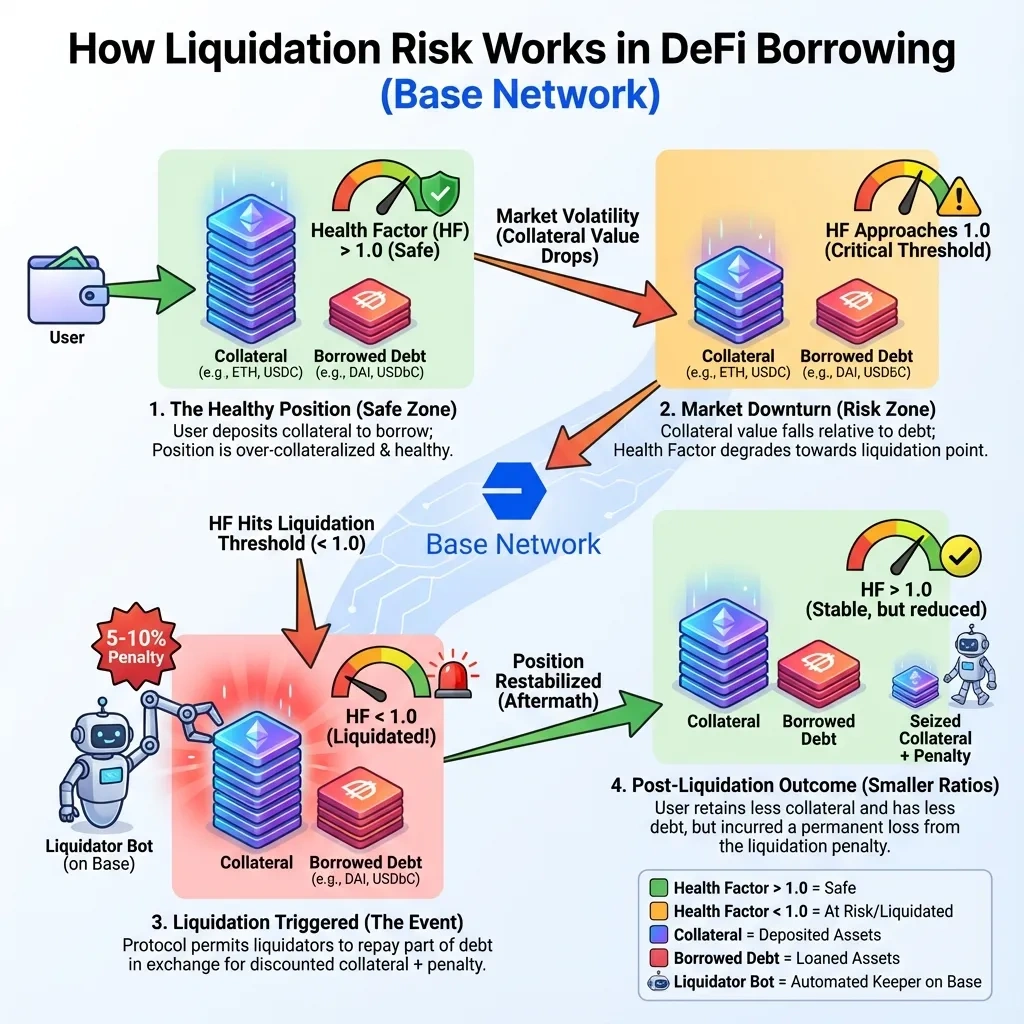

The Crypto Stompin’ Elephant in the Room: Liquidation

This is important, because this is how people get rekt. Remember your collateral? Its value can go down. If you borrowed $2,400 against your 1 ETH, and the price of ETH crashes, you’re in trouble.

There’s a liquidation threshold. Let’s say it’s 85%. This means if your debt (the $2,400 USDC you borrowed) becomes 85% of the value of your collateral (your now-crashed ETH), the system automatically sells your ETH to pay back your loan.

Boooo! You lose your collateral. You’re left with the USDC you borrowed, but your ETH is gone like your ex who took all your your Led Zeppelin vinyl albums when they left. This is why you always borrow conservatively and wateh the market. Remember, a small loan is a safer loan.

Staking for Non-Nerds - Earning Yield by Locking Things Up

Alright, remember back when we mentioned that the internet calls everything “staking”? It’s time to untangle that mess.

In the purest sense, “staking” means locking up your tokens to help secure a Proof-of-Stake (PoS) blockchain (like Ethereum itself) and earning staking rewards for it. You’re pledging tokens as collateral that helps ensure valaidators behave honestly. You get paid for locking up your tokens to secure the chain. Simple but elegant.

But, somewhere along the line, chip-crunching degens hijacked the term. Now, “staking” is a catch-all for any action where you lock your tokens in a smart contract to earn a yield. It’s less about securing the network and more about putting your money to work. We’ll roll with that definition because that’s how you’ll see it everywhere.

So, what kind of “staking” are you actually going to do?

Type 1: Single-Sided Staking

This is the simplest form. You take one type of token. Let’s say a new protocol’s token, maybe GECK0X, and you lock it in the protocol’s own staking contract.

- How It Works: You find the “Stake” page on the protocol’s site, approve the contract, and lock your GECK0X tokens.

- Why You Do It: The protocol pays you more GECK0X tokens as a reward (or maybe something else). This is usually to incentivize people to hold the token long-term instead of dumping it on the market like a bunch of cretins.

- The Risk: You’re at the mercy of a single token’s price. If GECK0X dumps by 50%, your staking rewards probably won’t cover the loss. You’re earning more of something that’s becoming worth less (maybe worthless too). Who buys lizard tokens?

Type 2: Liquidity Providing (LPing)

This is the big one. You’re not just locking one token; you’re providing liquidity to a trading pair on a DEX. In most cases, providing liquidity doesn’t really fall under the staking umbrella, but it’s worth mention here. You’re locking tokens in a contract to earn a yield.

- How It Works: You go to a DEX like Aerodrome or Uniswap. Instead of swapping, you go to the “Pool” or “Liquidity” section. Maybe you decide to provide liquidity for the ETH/USDC pair. To do this, you’ll supply both ETH and USDC in equal value for a full-range pool position. So, if you want to provide $1,000 in liquidity, you supply $500 worth of ETH and $500 worth of USDC.

- Why You Do It: You earn a portion of the trading fees from everyone who swaps that ETH/USDC pair. It’s like owning a small piece of the exchange and getting a cut of the all the in-range trades. You crypto mogul!

- The Risk - Impermanent Loss: This is the monster that eats LPers as snacks, ath least that’s what they say out there. But once you understand how it really works, it’s better described as divergence loss or even an opportunity cost. Let’s say you provided $500 worth of ETH and 500 USDC. If the price of ETH moons, your pool will automatically sell some of your ETH to buy more USDC to keep the 50/50 balance. You’ll end up with less ETH and more USDC than you started with. If you had just held your ETH, you would’ve been crypto-richer. The “loss” is “impermanent” because it only becomes permanent if you withdraw your liquidity at that time. Interenet hyperbole aside, it’s the price you pay for earning those juicy fees.

I’ll cover liquidity pools in more detail in a special post for you guys. Stay tuned. Liquidity pools have come a long way since the Uniswap V2 days. Lots and lots to discuss.

The Gecko’s Survival Guide - How to Not Get DeFi-Rekt

You’ve got the tools. You can swap, lend, borrow and stake. You’re a card-carrying DeFi pro. But there are bad guys out there who want your crypto. There are also PEBKAK errors to avoid. Look it up.

This is the most important section of this whole guide. Read it twice.

Freedom to transact on the blockchain also means the freedom to lose your bags. Let’s learn how to avoid that.

Rule #1: The Contract Rules All

In DeFi, the code is law. No backsies. No do-overs. If you send your life savings to the wrong address, it’s gone forever. If you approve a shady contract and it drains your wallet, that’s the cost of tuition, but it can be costly. There’s no undo button.

Read every single pop-up from your wallet. If it says “Unlimited approval,” and you don’t know what that means, stop. Figure it out. You’re your own advocate.

Rule #2: The Scam Test

Your gut is a better scam detector than any smart contract auditor. If something feels off, it likely is.

- If the project name or website domain name is mispelled, it’s a scam.

- If they’re begging you to “bridge” to a brand new, unheard-of chain to get their “airdrop,” that’s a scam too.

- If the only “community” is a Telegram group full of dopey bots spamming “TO THE MOON!,” it’s a scam, fam. Exect the liquidity pool to vanish.

- If someone on Telegram or X posts something about V2 or a token relaunch, don’t fall for it. Safe bet it’s a scam.

If it sounds too good to be true or seems a bit off, it’s probably a fly trap waiting for an unsuspecting fly.

Rule #3: DYOR (Do Your Own Research)

Don’t ape into something just because a tweet from an anon account with a pixwlated penguin smoking a cig for a profile picture told you to. Trust no one, and learn to be a blockchain detective.

- Check the contract: Use tools like Base Explorer, Honeypot.is, and Tokensniffer to check the token’s details. Thjere tools let you see if the token has dangerous functions and whether the liquidity pool can disappear leaving everyone with worthless tokens.

- Look at the tokenomics: Who owns the tokens? Is one wallet holding 50% of the supply? If so, they can dump on you at any moment. It’s not if, it’s when. Run.

- Find the team: Is the team anonymous? That’s common in crypto, but it can also be a risk. A doxxed team with a public reputation has a lot more to lose… and they can’t just swap screen names and do it all over again.

Rule #4: Start Small

- For your first DefI foray using a new-to-you protocol, use a trivial amount of money. An amount you’d be okay with losing if you accidentally fat-fingered the something in the UI. Transactions are cheap on Base and other Layer 2 chains. Test, test, test.

Get a feel for the UI, the gas fees, and the process. Once you’ve successfully done a few small transactions and feel comfortable, then you can think about using larger amounts. Crypto pros aren’t born; they’re forged by making small, survivable mistakes.

A few common-sense rules can help save your bags from disaster. Be smart out there, fam, Make some money, but be careful about it.